Bondaval announces US insurance partnerships with Hamilton and Beat

LONDON, 30th September 2021 – Bondaval has entered into a partnership with Hamilton Insurance Group, Ltd. ("Hamilton") through its Dublin-based carrier Hamilton Insurance DAC and Beat Capital Insurance Services, a subsidiary of Beat Capital Partners, to provide MicroBonds™️ to the North American Market

Hamilton is a Bermuda-headquartered company with shareholders' equity of $1.6bn that underwrites specialty insurance and reinsurance risks on a global basis, leveraging analytics and research to create underwriting and investment value for its clients and shareholders - a reputable partner for Bondaval's B2B clients.

Hamilton is delighted to partner with Bondaval as it introduces its revolutionary approach to streamlining asset security with the novel MicroBond concept. We're excited to support Bondaval's launch into the US B2B insurance space and see this new product having potential applications across many sectors.

Beat Capital Partners looks to support world-class insurance underwriters and innovative insurance solutions.

Bondaval has created one of the most innovative and exciting new risk transfer solutions we’ve seen. MicroBonds represent a step-change in B2B payment security, providing both suppliers and their merchants a better way to secure supply chain risk. We are thrilled to partner with them and look forward to making countless businesses more secure and capital efficient.

We’re thrilled to bring onboard such high-calibre partners. Hamilton and Beat have fantastic track records that speak for themselves. Partnering with them gives us an extraordinarily strong platform to build from as we scale across the US.

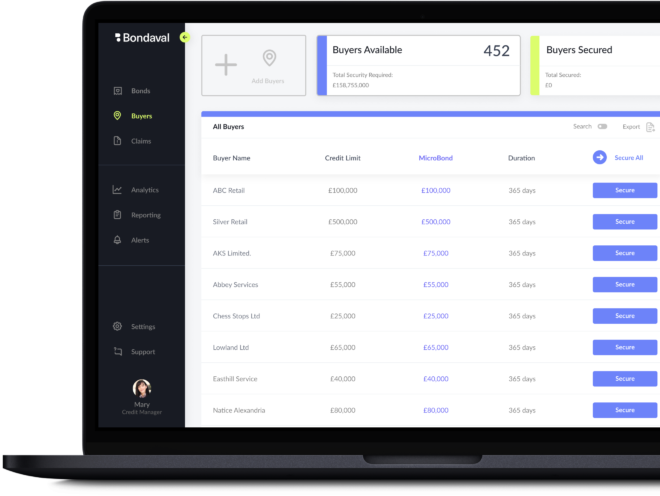

The future of B2B credit risk protection

-

Non-cancellable coverage

-

Up to 100% balance sheet protection

-

Secured and adjusted digitally