First-of-its-kind non-payment solution for global service provider marks first deal between Texel and Bondaval

LONDON 13 MARCH 2024 – The Texel Group (“Texel”) and Bondaval have closed their first deal together in an innovative, technology-enhanced structure for a cash securitisation programme.

The transaction enabled a leading service provider supporting FTSE 100 and Fortune 500 companies to expand their operations by offering targeted short-term financing arrangements to their clients.

Working with Texel, a specialist credit and political risk insurance broker, and backed by a major financial institution as financing partner, the client sought an insurance partner that could support their new cash advancement initiative.

Seeing the potential for a technology-driven solution, Texel involved Bondaval, a credit and surety MGA that issues flexible, digital security against non-payment risk by combining S&P A+ rated insurance backing with their proprietary technology.

Developing a bespoke, technology-enhanced solution was key to support our client, who has technology at the heart of their business. Bondaval were able to not only provide the level of cover our client required, but could adapt to produce something exactly tailored to the transaction.

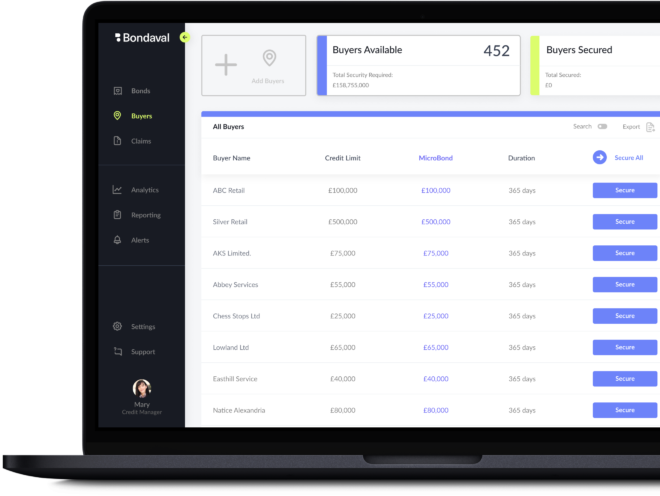

Designed in close collaboration with Texel, Bondaval’s solution allows the non-payment cover to match the live exposure the provider has to each of their customers, ensuring the most efficient possible use of available insurance capacity.

Within the deal, each of the service company’s clients is assigned a credit limit. As each loan is issued, it is automatically wrapped with Bondaval’s MicroBond product, granting the exposure non-cancellable cover, backed by S&P A+ rated insurance partners. Each MicroBond is matched to the value and term of the loan it secures, with the ability for the cover to be extended on a discretionary basis.

Additionally, as the deal was funded via an SPV, a bespoke wording was developed in conjunction with Texel to match the features of the transaction. Different access levels were also built into the platform to enable all parties to view relevant information on exposures and available cover.

For investors, this solution means that they can have peace of mind that the investments are being protected with exceptional cover. Meanwhile, the transparency of the process made possible via the Bondaval platform gives insurers a live view of their exposure.

Texel have demonstrated how a forward-thinking broker can find new ways to add value by combining insurance and technology expertise. We look forward to developing the relationship, alongside more innovative applications of our products.

About Bondaval

Bondaval combines insurance and technology to secure receivables for the world's best credit teams, so they can extend more credit, win more business and secure better financing terms. Founded in 2020 by Tom Powell and Sam Damoussi, Bondaval is licensed across 31 countries, with a global team of 30 across London, New York, and Dallas.

About The Texel Group

The Texel Group is a market-leading specialist insurance broker, primarily focused on the development, structuring and execution of credit and political risk insurance policies for its clients. Founded in 1997, Texel has grown to have over 70 employees across 5 offices globally (Brussels, London, Los Angeles, New York, and Singapore).

The future of B2B credit risk protection

-

Non-cancellable coverage

-

Up to 100% balance sheet protection

-

Secured and adjusted digitally