Bondaval raise $15 million Series A investment round

LONDON, UK: 14TH DECEMBER: Bondaval, a London-based B2B fintech that gives credit teams the certainty that their receivables will be secured, has raised a $15 million Series A Round, led by Talis Capital.

Bondaval will use the financing to continue building its best in class team, progress its global expansion, expand into additional sectors and use cases for the platform, and invest in its market-leading intellectual property. Bondaval has now raised more than $25 million to-date within a brief two-year period.

Investors in the round include existing shareholders Octopus Ventures, Insurtech Gateway Ltd, TrueSight, Expa, as well as new investors Talis Capital, FJ Labs, and Broadhaven Ventures. Thomas Williams, General Partner at Talis Capital, will join Bondaval’s board.

Founded in London in 2020 by former England Rugby Sevens captain Tom Powell (CEO) and Sam Damoussi (Chief Underwriting Officer), Bondaval’s proprietary technology can be used to modernise and simplify B2B payment security by fractionalising the underwriting process and cost, making it possible to cover risks more comprehensively, expeditiously, and across more applications.

What the Bondaval team has been able to achieve in its first couple of years is truly remarkable. We rarely see this pace and thoughtfulness of execution, which is a testament to the talented team that Tom and Sam are assembling, combined with exceptional demand for this product. The simple elegance of MicroBonds unlocks several transformational use-cases, which have the potential to fundamentally alter credit markets. We see limitless potential for Bondaval and are delighted to partner with this world-class team.

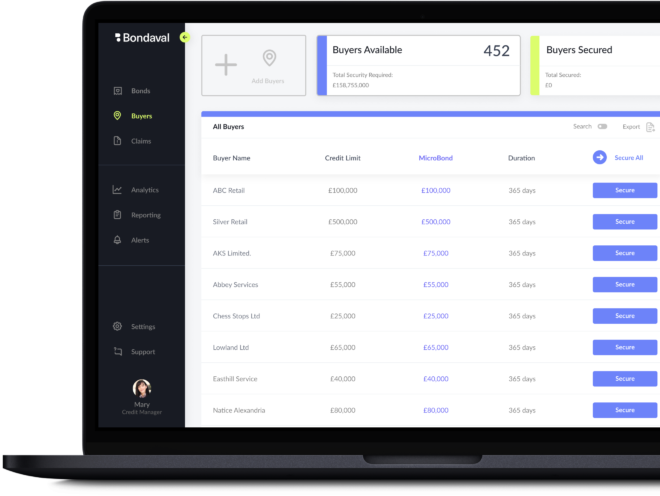

Bondaval combines credit analysis technology with S&P A+ rated insurance backing to create a more secure, capital-efficient and cost-effective form of receivables protection that can be issued, renewed and claimed-on digitally. The company’s key offering is its MicroBonds, technology-enabled surety bonds that secure receivables and can be easily purchased, and managed, through the Bondaval platform.

Primarily serving FTSE 100 and S&P 500 companies, including the likes of Shell, BP, Highland Fuels and TACenergy, MicroBonds replace traditional payment security methods, including bank guarantees and trade credit insurance, which can come with a negative balance sheet impact for customers, don’t always offer full indemnity and can be cancelled without notice.

Created for credit managers in large commodities companies, MicroBonds are non-cancellable digital financial instruments that provide 100% indemnity, have no collateral requirement, can be used alongside existing security, and be set up rapidly through Bondaval’s easy-to-use platform.

Unlike collateral-based security, like bank guarantees, Bondaval’s MicroBonds does not require customers to tie up capital in order to provide payment security to their suppliers. This can provide them with much-needed liquidity at a time when business costs are unpredictable and rising. Additionally, unlike trade credit insurance, MicroBonds cannot be cancelled and will provide 100% indemnity in the case of a default, giving suppliers confidence and certainty as they trade.

After backing Bondaval early on and working alongside them, it’s more evident than ever that the team has both the prudence and the pace to build a category-defining business in credit and insurance. We continue to be impressed by Bondaval’s ability to develop this innovative solution, drive value to some of the largest companies in the world, and continue building an exceptional team. Therefore, our decision to double down on supporting the company in this next stage of its journey was a no-brainer.

Since launching, Bondaval has expanded its team to 20 people, including the addition of Jochen Duemler, former CEO North America of the world’s largest credit insurer Euler Hermes (now Allianz Trade), as the company’s Chief Underwriting Officer (CUO) North America, Yoel Marson, former Director of Engineering at Yahoo! Answers, as its CTO, and Charlie Evans as the company’s Chief Commercial Officer. COO, Veronika Ostreyko, and Head of Data Science, Dr Lei Zhong, both joined Bondaval from Funding Circle where they were building, launching and scaling new credit products. Split across Europe and the United States, Bondaval has offices in both London and Austin, Texas.

Co-founder Tom Powell traded international rugby for financial services, and subsequently the technology sector. Co-founder, Sam Damoussi, spent more than a decade working in the surety market, which has allowed him to develop a particular expertise in insurance product innovation across international markets. Bondaval’s senior team’s unique combination of experiences has brought a novel and innovative approach to a largely static and antiquated sector.

When we first established the business less than 2 years ago, we could only imagine how quickly the market would respond to our technology-led approach for payment security. We are honoured by the confidence shown by our existing investors and our new investors and the validation from our best in class clients. We look forward to increasing access to more favourable financial security for all parties involved in B2B credit transactions and demonstrating more applications for our MicroBonds.

The future of B2B credit risk protection

-

Non-cancellable coverage

-

Up to 100% balance sheet protection

-

Secured and adjusted digitally