Bondaval secures $1.64 Million pre-seed funding

We are delighted to announce the closing of our initial funding round of $1.64 million, led by Insurtech Gateway alongside TrueSight Ventures and prominent angel investors such as Carlos Gonzalez-Cadenas (formerly COO of GoCardless, now Partner at Index Ventures), Yi Luo, Chris Adelsbach, Will Neale and Charlie Songhurst.

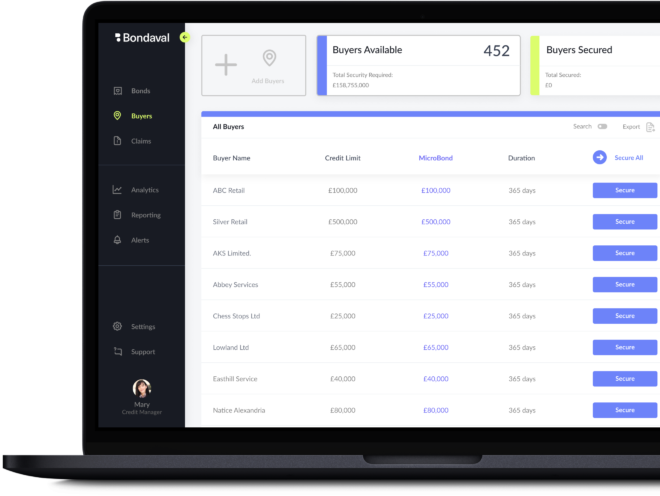

We’ve set ourselves an ambitious goal of democratising access to the best credit terms. We believe that the existing B2B insurance industry is unfair and uneven. To achieve our goal, we’re using a unique credit risk engine, which enables the instantaneous issuance of our innovative new product – MicroBonds. MicroBonds provide investment-grade certainty to wholesalers when securing their stock and inventory.

Founded in 2020 by Tom Powell and Sam Damoussi, the development of this novel insurance product is enabled by the use of data and technology. MicroBonds offer a new financial instrument to level the playing field for independent retailers by freeing up precious working capital. The co-founders have a shared ambition of bringing customer-centric and digital-first principles to a traditionally slow-moving and opaque sector and believe they are well positioned to provide an innovative new product offering to the €2.5tn+ of global exposure secured by trade credit insurance globally (ICISA, 2020).

We’ll be using the capital raised in order to accelerate product roll-out and invest in both recruitment and the development of our machine-learning technology. Regulatory and administrative approvals are underway, with commercial sales expected to start this year.

About the team:

Tom Powell was previously an international rugby player who transitioned into financial services and then the technology sector – the combination of these experiences formed his values and vision to bring a transparent, digital-first proposition into the B2B insurance industry.

Sam Damoussi has spent over 10 years working in the insurance-backed surety market and brings with him a wealth of deep domain expertise as well as a strong track record in insurance product innovation across international markets.

The wider team has been working together for the last year on validating its unique technology proposition, bringing on key executives such as its Chief Underwriter Finlay Smith (former CUO at RSA) and recently Head of Product Arthur Leung, formerly of 11:FS and Curve.

Independent retailers are competing on an uneven playing field when it comes to credit terms. We also see a huge delta in the user experience between the B2B and B2C insurance sectors. By leveraging technology and the founding principles of insurance we can level that playing field and vastly improve the user experience. We look forward to growing our team and raising the bar across the industry in order to deliver on our plans for the next year.

Independent retailers are competing on an uneven playing field when it comes to credit terms. We also see a huge delta in the user experience between the B2B and B2C insurance sectors. By leveraging technology and the founding principles of insurance we can level that playing field and vastly improve the user experience. We look forward to growing our team and raising the bar across the industry.

Bondaval's digitised product will make life so much easier and more efficient for Retailers to secure credit from their Wholesalers and Suppliers. We look forward to working with Tom, Sam and the Bondaval team to launch their proposition in Europe and the US.

Tom and Sam bring the rare combination of insurance industry expertise and the speed, agility and ambition of a tech startup. It is clear that there should be a more optimal solution for credit security for businesses across the world. We truly believe that Bondaval’s new MicoBond will provide just this solution, enabling business to maximise working capital and guaranteeing certainty in an increasingly volatile world. We are excited to partner with them as they start their journey.

The future of B2B credit risk protection

-

Non-cancellable coverage

-

Up to 100% balance sheet protection

-

Secured and adjusted digitally