Bondaval releases trade credit policy that delivers greater certainty over credit risk cover, without the admin burden

London, 27 JUNE 2024 – Bondaval, a leading insurtech offering payment default protection powered by technology, is launching its first trade credit insurance product. With the help of intelligent tools and guidance built into the Bondaval platform, users are equipped to effortlessly manage their policy obligations, understand what actions they need to take, and achieve greater certainty over their cover.

With its origins in their proprietary on-demand surety instruments, Bondaval’s next step into trade credit insurance reflects their ambition to offer a comprehensive suite of credit risk mitigation instruments. The company’s new S&P A+ rated trade credit insurance solution will launch in the UK and EU, backed by Great American International Insurance (UK) Ltd and Great American International Insurance (EU) DAC with support from Great American’s specialist Trade Credit and Political Risk Insurance division, FCIA.

“One of Bondaval’s core principles has been to give our customers certainty in the cover we provide to them. We first achieved that through our on-demand, surety-based instrument, the MicroBond. Now, as we enter the world of trade credit insurance, we have designed an offering that intelligently guides you through your policy, your portfolio and your obligations, so you still have that sense of certainty, without the weight of administration.”

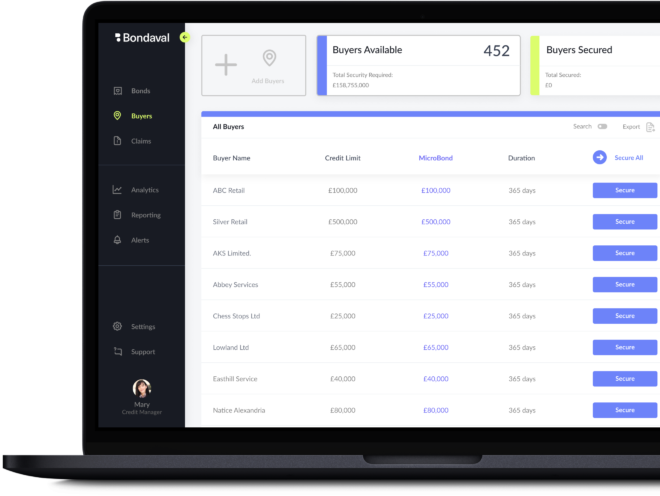

Designed and built by their in-house product and technology team, Bondaval’s platform offers a consumer-level digital experience for credit managers, allowing them to complete all core actions required for managing their policy via thoughtfully designed, intuitive flows that require little to no training.

The platform also fluently translates the terms of a client’s policy into clear tasks and reminders that adapt alongside changes within the underlying risk portfolio. This makes it straightforward for credit managers to understand and act upon any requirements needed to ensure comprehensive risk cover, resulting in greater confidence and peace of mind.

Our technology platform has been designed first and foremost to help credit managers do their job, not just to provide an efficient means of status checking. We’re doing that by giving our end-users powerful tools within a clear, elegant user experience that mirrors the consumer-grade software they use in their personal lives.

Since the founding of the business, Bondaval has invested significantly in their technology team, which now accounts for around 50% of headcount. Forster was an early member of the team at software start-up Yammer, which went on to be acquired by Microsoft as part of their Teams offering. Meanwhile Yoel Marson, CTO at Bondaval, was previously Director of Engineering at Yahoo! Answers, gearing the site to handle 1.5 billion views per month from over 200 million unique monthly visitors. This in-house technology expertise, which works hand in hand with underwriters, equips Bondaval to continuously deliver an intuitive, ultra-fast, customer-first experience.

Combining insurance and technology experts under one roof gives us enormous flexibility to design bespoke solutions that meet their clients’ evolving needs. We’re looking forward to working closely alongside both new and existing broker partners to discover opportunities to expand the market.

While Bondaval’s new trade credit insurance policy will offer significant benefits to credit teams through simplified policy compliance, enhanced portfolio insights, and ultimately greater peace of mind through the use of technology, the company’s approach to the market still honours the importance of client relationships to execute on those advantages.

Credit teams will all have different policy needs and legacy technology challenges. Working closely with our broker partners, our job is to understand those intimately and deliver a solution that optimises the way they protect their balance sheet. That’s the heart of it: we’re bringing intelligent technology and financial risk underwriting together, to help our broker partners add value to their clients and unlock net-new opportunities.

The future of B2B credit risk protection

-

Non-cancellable coverage

-

Up to 100% balance sheet protection

-

Secured and adjusted digitally