Bondaval and Great American Europe announce new strategic relationship in UK and Europe

LONDON, UK: 08:00 GMT – 30 NOVEMBER 2023 – Bondaval, an insurtech company offering digitally enhanced payment default protection to some of the largest companies in the world, has signed a multi-year agreement with Great American Europe, via Great American International Insurance (UK) Limited and Great American International Insurance (EU) DAC.

Bondaval’s platform-based solution will now be supplemented by Great American’s experienced team and S&P A+ rated financial strength. This collaboration will serve Bondaval’s clients further, helping them to achieve reliable balance sheet protection, limit relief and regulatory capital relief, through the use of Bondaval’s technology and security instruments backed by Great American’s capacity.

Great American joins Bondaval’s existing global panel of market-leading insurers and reinsurers. Their addition allows Bondaval to unlock even more long-term capacity, market expertise and risk insights for the benefit of their expanding blue-chip client base.

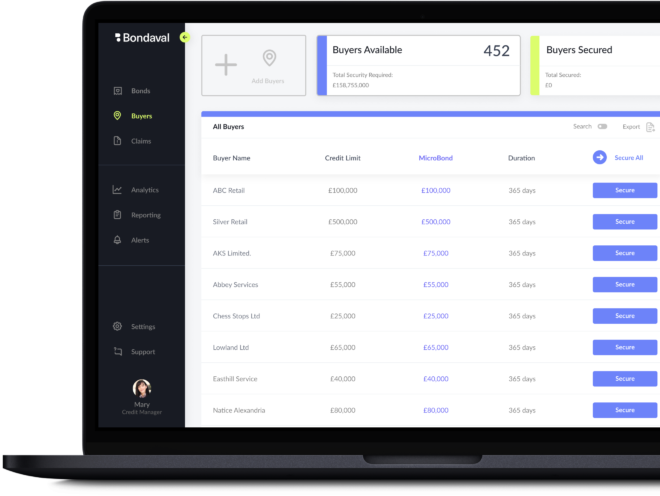

Bondaval counts supermajors BP and Shell among their clients, as well as other global suppliers. Their payment default protection underwritten by Great American is delivered and managed digitally via the Bondaval platform, significantly reducing the administrative burden associated with existing means of balance sheet protection, without incurring the heavy collateral requirements of other types of security.

Since beginning to offer our product, the response we’ve seen from the market has been overwhelmingly positive. Joining forces with Great American allows us to capitalize further on the significant opportunity in front of us in both the UK and Europe. This relationship means more cover, for more clients, capturing more market share.

For Great American, working with Bondaval provides an opportunity to grow its customer base and service more clients made possible by Bondaval’s proprietary technology, alongside the distribution opportunities and risk insights associated with a digital product.

The innovative nature of Bondaval’s products and the many opportunities they open up are very exciting for us. Through Bondaval, we hope to capture a new segment of the market, diversifying our portfolio and accessing a new pool of diligently underwritten premium.

The future of B2B credit risk protection

-

Non-cancellable coverage

-

Up to 100% balance sheet protection

-

Secured and adjusted digitally