Bondaval now directly authorised by the UK Financial Conduct Authority

LONDON, UK: 14TH FEBRUARY 2023: Bondaval, the B2B insurtech issuing digital MicroBonds, is now directly authorised by the UK Financial Conduct Authority.

To be directly authorised, Bondaval had to meet the requirements of rigorous due diligence from the FCA. That included demonstrating the existence and maintenance of required policies and procedures, the strength of our business model and the leadership team behind it, as well as providing adequate evidence for the validity of MicroBonds and their benefits.

As a directly authorised company, Bondaval now has the ability to manage a number of controlled activities without need for recourse to their regulatory host.

Becoming directly authorised is a vote of confidence in the robustness of Bondaval’s business model and its product. The level of control that direct authorisation gives us also sets the company up to scale. Owning our systems and processes helps us to deliver positive customer outcomes more easily as we grow, while ensuring ongoing compliance. We are delighted to achieve this milestone.

While being an Appointed Representative, supported by early investor Insurtech Gateway, afforded Bondaval quicker entry to the market, becoming directly authorised has always been on the horizon. In addition to the enhanced activities Bondaval can now undertake, the authorisation from the UK regulator also provides a badge of trust to Bondaval clients.

As a young company in a highly regulated industry, it’s especially important for us to make sure that our clients can trust us. Whether it’s our prudent underwriting approach, our measured growth strategy or now being directly authorised by the FCA, we are demonstrating that we are here for the long term.

The future of B2B credit risk protection

-

Non-cancellable coverage

-

Up to 100% balance sheet protection

-

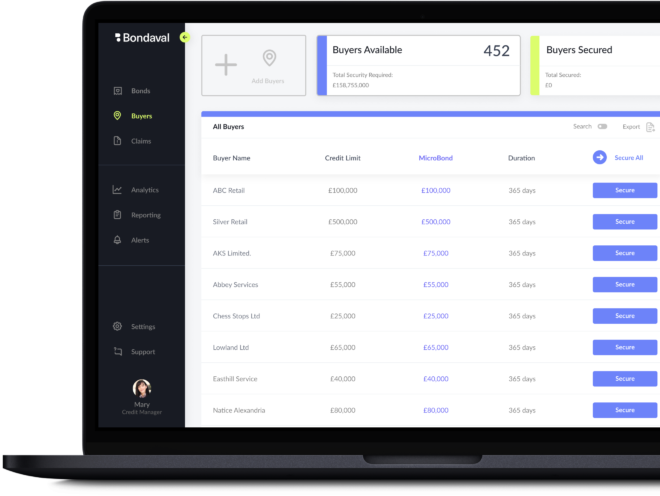

Secured and adjusted digitally