Bondaval launches new reinsurance vehicle to underpin significant ongoing growth and align with (re)insurance partners

LONDON, 30 MAY – Bondaval, an insurance technology business offering digitally-enabled payment default protection, today announced it is establishing a reinsurance vehicle to lay the foundations for its continued growth.

The new vehicle, Bondaval Re, marks a significant new chapter for the business, which has so far been operating exclusively as a managing general agent.

Founded in 2020, Bondaval’s total gross written premium has increased by over 10x year on year since its commercial launch in 2022, while still maintaining excellent underwriting performance. The company now operates in 31 countries, with a team of 34 and offices in London, New York and Dallas.

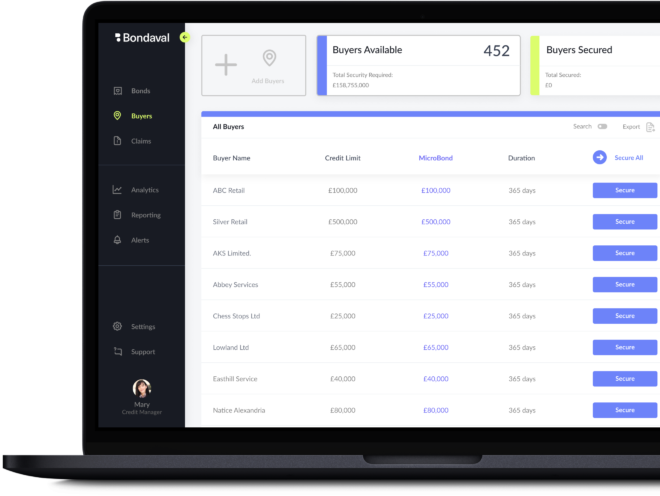

The bulk of the business’s growth has come from its stable of blue-chip clients, who seek a technology-driven solution for securing their credit risk. All products within Bondaval’s suite of solutions are delivered via its proprietary software platform, which provides a seamless experience for credit managers as they secure, review and claim on risks.

In addition to supporting ongoing growth, Bondaval Re will allow Bondaval to partner directly with reinsurers as well as insurers, including those within their existing global reinsurance treaty, to further expand the potential opportunities the business may seek to pursue.

The move will also align Bondaval’s underwriting interests even more strongly with those of their insurance and reinsurance partners as they take reinsured risk onto their balance sheet for the first time. Clients will continue to face Bondaval’s insurance partners directly, benefitting from S&P A+ rated cover.

Launching Bondaval Re will provide a scalable solution with which to support the company’s continued growth, as well as to prepare for further planned expansion. By creating a close alignment of risk between Bondaval and our stakeholders, we demonstrate our long-term investment and commitment to the business, and confidence in the calibre of our underwriting.

Bondaval Re has been made possible through financing provided by Dawn Capital, Europe’s leading specialist B2B software investor, alongside continued support from Octopus Ventures and other existing investors. Dawn has deep expertise in supporting world-leading finance and insurance technology companies as they expand globally, with previous investments including mobile payments company iZettle (sold to PayPal for $2.2bn cash), open banking platform Tink (purchased by Visa for $2.0bn), and embedded insurance provider, Cover Genius.

Bondaval is combining innovation at the insurance product level with a technology platform that enables greater transparency and granularity in underwriting. This is expanding the addressable market of risk that can be protected, and we believe will play an important role in securing the fast-growing economy of global trade. The company's growth to date has proven that there is significant appetite for its offering, and we are delighted to be supporting this stellar team as they transform the daily working lives of credit teams at some of the world's largest businesses.

Receiving backing from a VC like Dawn Capital with such an impressive track record is further validation and a strong vote of confidence in Bondaval and our expansion strategy. We're excited to start this partnership and look forward to continuing to execute against our plans.

The future of B2B credit risk protection

-

Non-cancellable coverage

-

Up to 100% balance sheet protection

-

Secured and adjusted digitally