Bondaval launches MicroBonds™️ in partnership with Arch and Hamilton

23rd June 2021, London, UK: London-based insurtech startup Bondaval today announces its launch of the world’s first MicroBond, which offers a new class of credit security. The launch is supported by a ground-breaking agreement with Arch Capital Group and further supported by Hamilton Syndicate 4000, the Lloyd’s operations of Hamilton Insurance Group, Ltd. (“Hamilton”), as reinsurance partner.

Arch Capital Group is a publicly listed company (NASDAQ: ACGL) with market cap of $16 billion, AUM of $40 billion and $10 billion GWP. Its market leading position has earned it S&P A+, Fitch A+ and Moody’s A2 ratings, allowing Bondaval to establish trust with its B2B customers.

We are excited to be collaborating with Bondaval in their unique approach to this specialty class, their technology play is fresh and innovative. We are very much looking forward to expanding and growing this opportunity together over the long term.

We are thrilled to partner with Bondaval, the team’s vision for transforming the world of B2B insurance is incredibly energising and we look forward to working closely together on this powerful and promising journey.

Bondaval was able to secure these two key partnerships because of its innovative approach and commitment to utilising technology to unlock the potential of MicroBonds in the UK. Founded in 2020, Bondaval are delivering on their promise to modernise B2B insurance much in the way that other insurtech companies have done for consumer lines.

We’re proud to have secured such notable and reputable partners as a relatively new company and are grateful to Arch and Hamilton for their confidence in us. We don’t take their endorsement lightly and will work to bring greater transparency, innovation and customer benefits through our MicroBonds. With these binders signed, we are pleased to introduce MicroBonds in the UK and start to deliver on democratising access to the best credit solutions.

The future of B2B credit risk protection

-

Non-cancellable coverage

-

Up to 100% balance sheet protection

-

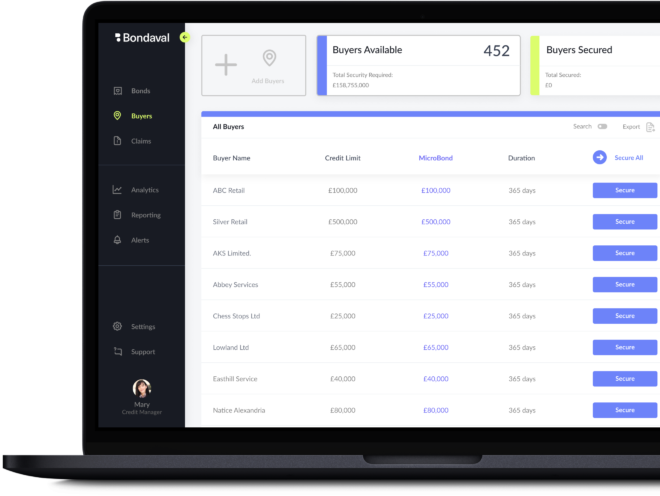

Secured and adjusted digitally