5 minutes with Veronika Ostreyko: unlocking growth

How has your career developed so far?

I began my career in strategy consulting. It was an amazing place to start from, because you get to work with different clients, across a range of industries with interesting problems to solve: cutting costs, entering new markets, competitive analysis... So you very quickly get a well-rounded view of how businesses work.

What I was missing was having skin in the game: you work hard on a particular issue for a client, you hand it over, and then you move on. You don’t see the real impact of your work.

That changed when I went to Funding Circle, an online platform for small and medium business loans. There, I was driving a variety of initiatives from leading international expansion, to managing complex change projects or optimising commercial performance.

Most recently, I also oversaw the launch of a new short-term credit product: from developing a vision for the product and conducting the market research for it, to scoping the build and hiring the team to deliver it, to then scaling and optimising performance post-launch.

After going through that hands-on, high growth journey, I realised that was the kind of environment I was most drawn to. And I also really enjoy the breadth and variety of work that comes with it.

How do you approach scaling a business?

I’ve worked in a variety of different contexts, whether that’s advising large companies looking to enter new markets or change their operating model, transitioning from a pre-IPO to post-IPO environment, or building a start-up within an established business.

In all those different settings, you face different challenges. The dream and vision for each company is different, as well as the context, so I don’t think it works to apply a universal framework to try to dictate how growth should happen.

But there are straightforward questions you can ask yourself as you go. What are we trying to achieve? What does success look like? How can we go about measuring it? These can help create clarity throughout the process.

Ultimately though, it comes down to different people across the business working together to achieve a common goal. So there needs to be enough tools, processes and communication channels to enable people to collaborate and perform at their best. And the extent of these differs depending on the stage of growth. Having a clear idea of what you’re trying to achieve and how each team contributes towards the company goals is always a good place to start.

What’s the main operational priority for Bondaval as we grow?

The most valuable thing for us right now is to take things step by step, and maintain a degree of flexibility. We have to figure out for ourselves what the next few stages of our development will be. We don’t need to go from A to Z right away, but we will figure out how to get there, one leap at a time, and adjust accordingly.

And in reality, the market may not go along with our plans, no matter how well thought through they are. When Covid hit at my last business, we needed to completely reassess our focus and priorities. These were new challenges, that we couldn’t have foreseen, but it prompted us to reconsider how we can serve our customers better. Ultimately, it resulted in us launching multiple new credit products that provided invaluable cashflow support for small businesses.

Even without global events like that, there are always unplanned deviations that you need to account for. Being able to adjust and optimize is vital. Otherwise, we will miss opportunities to build the best possible offer, or to serve markets that need our product.

Being agile doesn’t mean being reckless or not having a plan; we always need to make sure we have enough process in place to execute well. We just need to make sure we don’t let bureaucracy creep in as our business develops. If we continue to improve our levels of innovation and customer service as we grow while attracting and retaining fantastic people, we will be in an excellent position.

How MicroBonds protect balance sheets -->

Why did you decide to join Bondaval?

Funding Circle was an amazing environment to work in: it was mission-led, full of smart people, doing interesting work that was helping small businesses. I had a very high bar for the next place I wanted to work at.

Bondaval easily surpassed that bar. Within the first 15 minutes, I knew I wanted to join. The more I spoke to Tom [Powell, CEO] and met more of the team, it became clear we were working on something new, that lots of different people could benefit from. And as for the team themselves, everyone seemed driven, switched on and motivated, but also humble, fun and genuinely nice. The people here were definitely a decisive factor for me.

Now I’m here, it’s certainly living up to my first impressions. There’s nothing too precious that you can’t give feedback on or suggest improvements for because everyone is working together to make things better. We’re all in the same boat. Of course, it’s not easy creating something new, but if we wanted to continue with the same things that came before, we’d be in a different business.

We have an incredible opportunity in front of us. We’re very fortunate to be well capitalized, so we have the resources to go after it, and we have the brains internally to figure it out. For me, this stage we’re in is really exciting.

Check open jobs at Bondaval -->

The future of B2B credit risk protection

-

Non-cancellable coverage

-

Up to 100% balance sheet protection

-

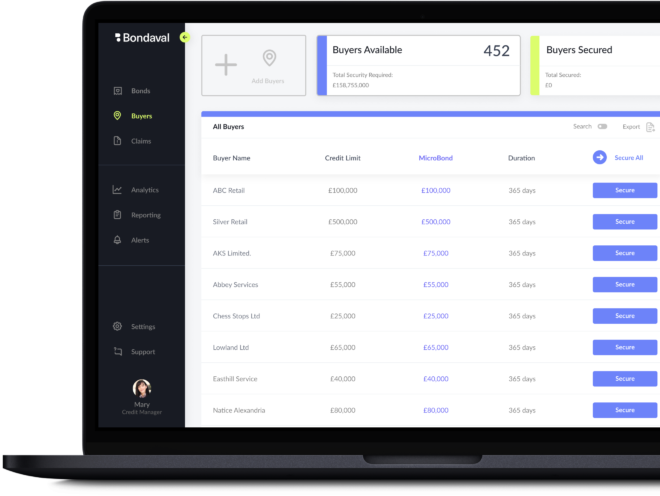

Secured and adjusted digitally