5 minutes with Ryan Ladwa, on start-up culture and growing through innovation

What’s your background?

Before I joined Bondaval, I was at Citi in their Debt Capital Markets and Banking divisions.

There I was primarily helping the world’s largest corporates in two ways. The first was advising them on their financial strategy: how to raise debt, how to think about strategic financing to fund acquisitions or refinance their entire capital structure. The second was then helping them to execute on that strategy, whether that meant tapping the corporate bond market or using bank capital financing.

I was quite lucky with the experience I had at Citi. I never had the nightmare scenarios or horrible bosses you sometimes hear about in banking.

But I was intrigued when I saw the role at Bondaval come up. It represented an exciting opportunity for me to move into a different world, while still using my core skill set, but learning a lot.

How have you found the difference between working at Bondaval versus a large corporation?

To be honest, I was always a bit sceptical of the start-up dream. Going from a 200,000-person organisation to a company of just 25 was not what I expected my next move to be. However, looking back it was definitely the right time to move out of a big corporate for me.

Sometimes companies talk about their values (for example, one of Bondaval’s is that we’re “family-first”), but you don't really know for sure until you’re in it. Here it really does ring true, with some of the things that we do here day-to-day, whether it's Thursday drinks or playing tennis at lunchtime, our off-sites and the “mildly competitive” Strava group… I had imagined a workplace like that, but never experienced it.

The biggest difference though is the variety and scope I have within my role. At a big corporate, there’s an overall production line and huge teams who each own their piece of a transaction. That means you can become really specialised in your particular area, but you don’t always have the freedom to stretch your legs and develop a broader set of skills. At Bondaval there’s a lot more growth potential, because you’re taking on a wider range of responsibilities.

How do you see your role at Bondaval?

The beauty of my role is that I have a hand in both the strategic and the business-as-usual. After all, you can have the best strategy in the world, but you still have to execute on it and make sure that everything goes to plan.

As a bare minimum, your strategy needs to be ensuring that nothing goes wrong. While that may feel like a passive goal, there’s a lot that goes into making sure that things stay on track, as I'm sure the credit managers we serve would agree. You need good overall discipline and maintenance, and you need to constantly challenge yourself to improve processes, making things less manual and more automated where possible, so you can cut down time while achieving higher accuracy.

We already have a tight handle on that, which is great, so the next phase for us is making sure we’re set up to scale. That starts with super simple things, like building out our Treasury strategy, and making our funds work for us, which goes hand in hand with broader questions like how we might want to engage with investors and what funding source is best to help us grow.

Another key responsibility of mine is making sure our financial and commercial targets are clear and improving their reportability, so that we can easily communicate them to all our stakeholders, internal and external, and benchmark how we have done against what we planned to do.

Of course, I'm focused on numbers, but just showing the team whether we’re up or down month on month doesn’t really tell us anything. What’s most useful is providing a feedback loop, making sure everyone knows what the milestones we need to hit are, then keeping people accountable so we can smash through them.

What do you see as the growth path for Bondaval?

What we’ve managed to achieve in a such a short space of time is pretty remarkable. We’ve raised $25 million, we’ve hired some fantastic talent, and we’ve got some impressive logos on our register.

That’s down to how useful the product is for credit teams, both at corporates and financial institutions (given the capital relief benefits they can achieve), as well as the huge potential within our market.

When most people outside of the industry think about fintech, I’m sure the Revoluts and Monzos of the world come to mind as they face off to consumers. But even though B2B fintech isn’t as visible, it’s a much larger market overall.

And particularly in our sector, it's a relatively untapped, somewhat legacy market, so there is plenty of room for innovation and appetite for something different.

That innovation is a core part of Bondaval. We're a risk-based business, so we can't just grow by giving the same products to more people. Much like with lending, for each product, there are eligibility criteria and risk thresholds. Instead, we have to invest in product development so we can find ways into new markets. That’s how we achieve our growth: by creating something new.

The future of B2B credit risk protection

-

Non-cancellable coverage

-

Up to 100% balance sheet protection

-

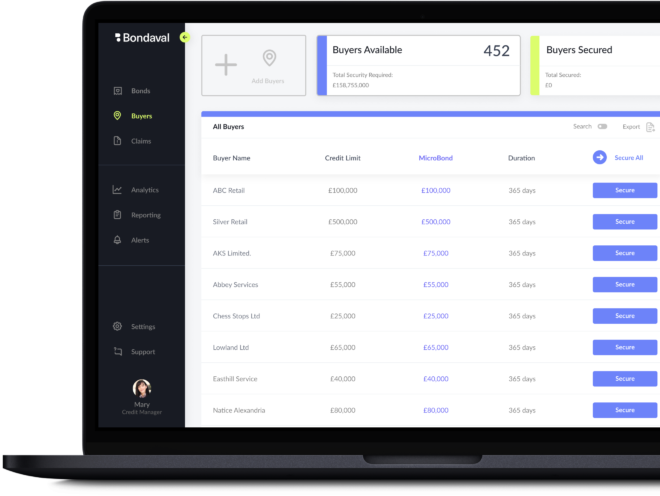

Secured and adjusted digitally