5 minutes with Josh Heslin: building greenfield credit technology

What has your career history looked like so far?

My career trajectory is probably not typical. I started off specialising in geotechnical engineering, things like looking at rock and soil strength. Imagine a big skyscraper, built on the ground. How do you know the ground won’t suddenly fall away?

It was really interesting and I was quite good at it. I got the best mark of my graduating cohort, and that led to a scholarship to work for two years on a mine site. As part of my work, I was doing some computer programming and really got the bug for it. So I decided to learn how to code properly so I could switch to software engineering on a full-time basis.

For me, that was the best decision ever, because civil and structural engineering is not very cutting edge. They're trying to improve, but the focus is more on getting the project done versus how we might innovate. But in technology, it’s all about how you might solve a problem and there really isn't any restriction.

Perhaps because of my engineering background, my approach to building software is extremely pragmatic. As long as you're solving the problem and it’s all safe and built in the right framework, the exact specification of the solution doesn’t always matter. There might be 10 different solutions to the same problem; the main thing is solving the problem.

What make you want to join Bondaval?

For me, it was the team. It’s straightforward enough to go and build software, but only a few companies can build software for the right problem, with the right team, who have the right background.

With some newer companies, there aren’t really any adults in the room, but here there are plenty. This isn’t your average start-up: it’s a well-considered, well-run, well-funded company. For example, Yoel has held CTO roles for 15 years. I'm learning so much from that.

In the tech team generally, we’ve got a great mix of skills and backgrounds, and we’re very high-performing. A lot of dev teams can get caught up in deciding what they are going to do, and it can take forever to get a consensus on how to move forward. Here, we’re very efficient and motivated to get things done.

The other thing that clicked with me was the data side of things. Like mining, insurance is a bit of an old club, but what we are doing here is trying to change that up: to digitise and modernise the sector. That’s something that everyone in the industry sees the need for, and why we’re getting so much traction.

As I see it, how we approach data is our biggest opportunity. It’s pioneering, challenging work, where we have to think about how we ingest the data, how we gain insights from it, how we relay that back to our underwriters and to clients. There’s a machine learning side to this, a financing side and a credit underwriting side that all need to play together. But if we get it right – the data, the flow, the insights – that will be an incredible edge for us.

What do you do day to day?

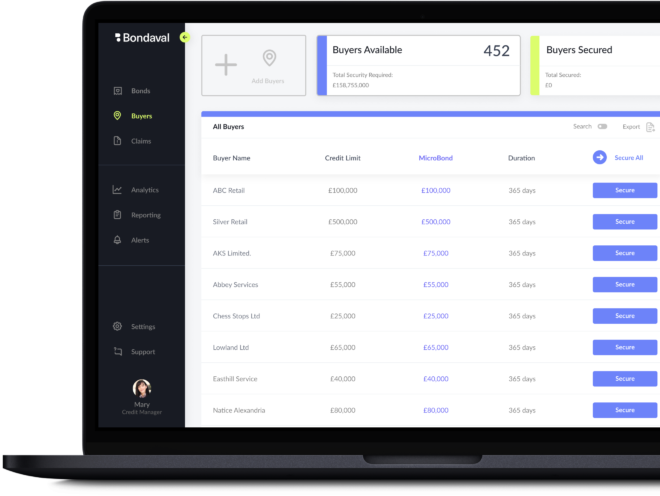

Most of what I do comprises of building features for the platform. Most of what we do is completely greenfield: some of the things we’re building, like deriving underwriting insights from a live feed of accounts receivable data, has never been done before in the industry, full stop.

In that example, we’re able to spot patterns in how a customer is paying, so we can flag if anything is changing. And most importantly, it’s based on live material, rather than a credit report which could be 12 months old. So we’re surfacing a brand new way to underwrite credit risks, and feeding it back in close to real time.

To build these features, we work really closely with the underwriters. They’re giving us feedback on the work we’re doing, but they also feed into the roadmap of what we’re going to build, so it’s very collaborative.

At the really big organisations, underwriters may never have really had much tech to support their work. Something I love is how we’re able to build tools that allows them to be more efficient and to speed things up for them. It’s such an elegant use of technology.

If someone were considering applying to work at Bondaval, what advice would you give to them?

First off, you don't have to have worked in the insurance industry to be a developer here. In the tech team, most of us haven't, but we have an eagerness and willingness to learn. So if you have that, you’ll be fine.

Having said that, be prepared for the learning rollercoaster. For each new thing you understand, you’ll discover another you need to get your head around. It’s worth it, because you’ll be constantly building a foundation and you do become really knowledgeable really quickly, but it’s worth preparing for the up and down from the outset.

And don't worry too much about the technology choices that we have. Again, if you're willing and you're ready, you will pick it up. As a team, we're always happy to teach and learn. If you're someone like me, who loves the journey of, ‘I don't know, but I'm willing to learn’, then this is the perfect place for you.

Interested in joining Bondaval? Visit our Careers page for open roles and how to apply.

The future of B2B credit risk protection

-

Non-cancellable coverage

-

Up to 100% balance sheet protection

-

Secured and adjusted digitally