5 minutes with Jochen Duemler: innovation in trade credit insurance

Why did you join Bondaval?

I came across Bondaval after leaving Euler Hermes when one of their investors, Joe Zuk, introduced me to the two cofounders, Thomas Powell and Sam Damoussi. I liked them both then, and I still like them now.

From the beginning, I found Bondaval’s product to be a fascinating idea. It’s a completely new approach to securing trade credit risk, and it can absolutely work – in fact, it is already working. This is a brand new instrument, and so it’s natural that people will need time to become familiar with it. But some of the largest companies in the world are already working with and benefitting from our MicroBond solution.

For credit managers looking at protecting their receivables, they have a number of avenues open to them. They might choose trade credit insurance; they might ask for some form of collateral; they might decide to self-insure. What we’re doing at Bondaval is adding another option to the table: MicroBonds.

The nature of MicroBonds automatically takes away some of the biggest flaws of the trade credit insurance product: its conditionality, the complex claims handling and typically some form of self retention.

The simplicity of MicroBonds and the strength of the guarantee also means that it is suited to other applications beyond simply covering credit exposures. There’s a large market of supply chain financial risk where you might employ MicroBonds to protect yourself, and other risk management use cases like that. And there’s a financing future as well, where securitizing receivables with MicroBonds might confer some structural advantages to a company’s balance sheet.

How innovative is the trade credit insurance industry?

The nature of trade credit insurance is that you have infrequent, large claims, as opposed to the very frequent, minor claims of health or motor insurance. And it’s cyclical: different sectors and different regions go through periods of boom and bust, and every so often there is a widespread recession, like in 2008. In short, it can be quite a volatile industry, and so it’s become concentrated: just a few major players dominate the world market.

For some of those big insurers, who have made major investments in their underwriting headcount, to radically change their product would require a complete questioning of the business model, from top to bottom.

Of course, there has been continuous product development, but nothing that has come up with something completely from scratch, rather than building on what already existed. You might add on extra technology here and there, but it’s never radical.

There’s certainly value in trade credit insurance, especially for companies that do not have the ability to underwrite risks in-house. They might prefer to outsource their credit management to a credit insurer, who can set limits on their behalf.

But there is definitely an innovation weakness in trade credit insurance, and everybody within the industry can see it. Technologically, it has not developed as much as it could have done. Bondaval’s product – both the product itself and the way it is delivered, entirely digitally and in a modular way – is a big step in the right direction.

What is the priority for Bondaval right now?

Our mission at this stage is to keep building a solid foundation to our portfolio by continuing to partner with industry-leading companies. When you’re underwriting risk on a non-cancellable basis, you really have to know what you’re doing. You need to intimately understand your client’s business, know about the industry and territories they operate in and see how they apply their credit policies throughout the organization. There needs to be a strong credit culture there to begin with.

Of course, we also need to neutralize any risk of fraudulent behavior, as well as eliminating the risk of complacency, where an organization, or even a single credit manager, knows that they are covered, and so they don’t complete their own credit processes as thoroughly as they should do.

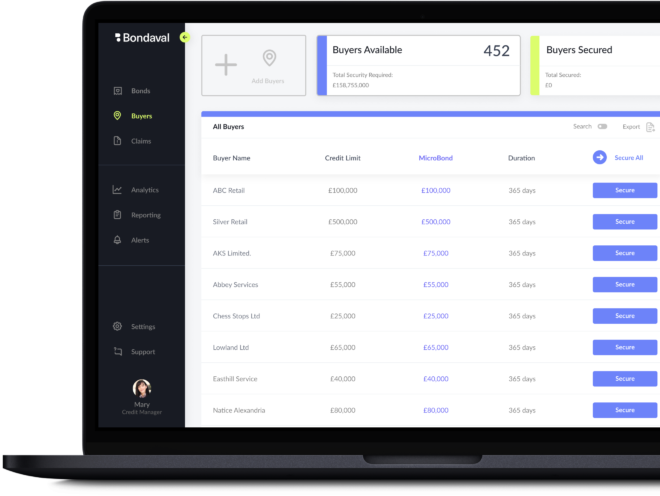

We do this by giving high integrity partners access to our cutting-edge technology platform. This creates complete transparency through the credit process and in return unlocks a superior risk transfer mechanism for the customer.

This is a real paradigm shift. We are able to leverage our technology to front-load all of the work which is traditionally done after a claim occurs. This means, when something does go wrong for one of our customers, we can pay the claim immediately rather than second-guessing their credit team. We’re there when it matters most, no questions asked.

How is Bondaval approaching underwriting?

The important thing for us is to underwrite in a way that allows us to grow sensibly. That means we are prudent, and we are very selective as far as our clients are concerned.

That way, our growth and technological development can continue evolving at the same pace, allowing us to gain more traction and spread into other industries with more confidence. But we have to build up incrementally and learn from each step of the journey.

We may even get to a point where we advance our data processing so far that we can spread to a very wide range of companies. For the largest and most complicated risks, it will always be necessary to review them manually, alongside the technology. But there is a large band of risks that we can already underwrite automatically, and that band will only grow.

Why didn’t anybody do this before? Because the technology simply wasn’t there.

I remember how we used to manually analyze balance sheets before; it was a totally different world. Like we think back to a time when there were no electric cars, at some point, we’ll think about the time before digitally provided MicroBonds. For me, this is what technological innovation looks like.

Check open jobs at Bondaval -->

The future of B2B credit risk protection

-

Non-cancellable coverage

-

Up to 100% balance sheet protection

-

Secured and adjusted digitally