5 minutes with Forrest McMillan: solving problems in credit

What’s been your history working in the credit world?

I started as a credit manager for a global steel manufacturer straight out of college and ended up managing their international portfolio as well. There, we were using trade credit insurance to secure all our receivables that went outside the US, plus our two largest US concentrations. This gave me a good education in managing credit in commodities during a rising price environment in the mid 2000s.

After we were acquired a few years later, our TCI broker at the time asked if I wanted to open an office for them in Dallas, so I did. I got my broker license on August 30th; ten days later, Lehman Brothers blew up, and the trade credit markets were changed significantly. We didn’t really have a product to write for the first year or so, since the insurers needed to recover from their losses and understand just what was going on.

I brokered trade credit insurance for about 13 years until 2021. Numerous clients approached me over the years to work full-time for them to be head of credit. Instead of that, I did some consulting for them: setting up processes and procedures, finding the right people to help them to set up the right systems, running education classes for people periodically to talk them through Credit 101.

Finally, I went in-house with a global aviation fuel supplier that I had been consulting for years. I stayed there a little while before I moved to Bondaval at the beginning of 2022.

I had seen Jochen Duemler was involved with Bondaval. I had known him from his days at Euler back when I was a broker. Seeing his name stuck out to me. Why is this guy, who’s made it to the top of the mountain, at this startup company? So, I reached out to him, and off we went.

What’s your view of the trade credit insurance market?

As a broker, I spent years looking at trade credit insurance, and had steadily become convinced that, at some point, someone needed to figure out how to modernize this product.

What I mean by that is that trade credit insurance is an atypical insurance product. The language is not standardized. It’s not set forth by the federal government or the state. The contracts all cover the same things, but the manner they go about doing that varies from carrier to carrier. And within each carrier, they have different flavors of each of their policies.

So it’s a highly complex, highly conditional program. And while I was a broker, I watched it get more and more conditional. The contracts were never getting simpler. They were only getting longer and full of more conditions, and more exclusions, and more endorsements. We’d look at it and say, there has to be a simpler way to do this.

Whenever someone new entered the market, it was just the same product with new capacity. So you had a new insurance carrier – but they’re just offering the same trade credit insurance contracts that the other carriers are offering. No-one’s adding anything or doing anything differently. No one was changing the mechanism underneath it all.

In the TCI world, things are very fixed. And even if there’s no real reason not to do something, and the new solution makes sense, the mindset isn’t one where people will spring into action to make it happen. It became clear that to modernize trade credit insurance, you needed people who were not from the world. You needed to take a product with an entirely different application within the credit world, and eventually you run right into trade credit insurance.

The founding ethos of Bondaval was never to replace trade credit insurance. But part of being an innovative business is providing a meaningfully different product: a totally different approach, not just a new name on an old face.

Even now in the early stages, what we’re doing is fundamentally different to what exists in the market or what has existed for the last few decades. Our product gives us the ability to restructure and be more flexible. Since the underlying security is so neat and clean, we can adapt our service agreement without having to change the underlying product. We can start solving problems for people, without worrying we’re going to break something somewhere in our 86-page credit insurance contract.

How can businesses actively manage credit?

I’m a big believer that trade credit is what makes the business world go round: extending the movement of goods and services on open terms. But it’s a business function that is often underinvested in and ignored by management.

A lot of times when I was consulting for credit teams, they were starting from scratch. They didn’t have any repeatable processes in place. That wasn’t exclusive to a certain size company; I’ve seen multibillion dollar companies with 10+ people doing collections, but no one actively onboarding and managing their credit function. They’re just on the phones and emailing all day, trying to get invoices paid as fast as possible.

I believe more businesses could benefit from a mindset shift in how they view their credit department. When they stop viewing credit as just a collection function of the business and actively begin managing credit, then credit can radically improve the strength of a business. That means shifting people's mindset towards how to onboard and manage risk.

That might look like building reports to identify why our large past dues are occurring or quantifying the value of time spent onboarding a customer and collecting payments. For example, if you determine it will take you 2 hours to collect a delinquent receivable, put those 2 hours into the higher value invoice. Simple things like that.

You need to be as proactive as possible to identify problems before they happen. Are there any ways we can identify problems with receivables before they become due, because we know they are associated with certain behaviors from the client?

For example, maybe your sales pricing is so complex that inevitably there will be issues trying to bill the invoice properly which will ultimately delay when it gets paid. With automated payment systems, you have to be especially on top of things, because when they go wrong, they go really wrong. There’s no person to tell you something is missing, or hasn’t worked, and when the system rejects your invoice, they don’t flag it; they wait until you call up and ask, which is to their benefit. By the time you realize there’s a problem, it’s already snowballed.

Understanding why things aren’t working can be an investigative challenge. When you’re dealing with huge international customers, with so many teams and systems and locations, it’s not as simple as ‘Hey, call them up and tell them to pay us.’ There’s more to it than that. That’s the nature of credit: every day presents us with a new problem to solve.

Check open jobs at Bondaval -->

The future of B2B credit risk protection

-

Non-cancellable coverage

-

Up to 100% balance sheet protection

-

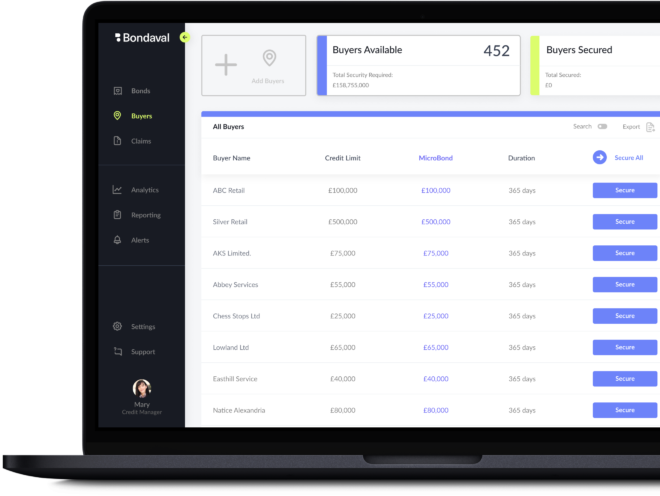

Secured and adjusted digitally