5 minutes with Charles Mensah: advancing credit with technology

How has your career in credit developed over time?

Like many others, I went into credit by accident. But I immediately loved the profession because I could apply everything I had learned about business and economics from my studies. I also appreciated the importance of credit to all businesses and how it enables them to grow. Making credit available in a fast, efficient manner is a core way to help businesses.

I’ve worked in credit for my whole career, starting at ExxonMobil, and I’ve steadily added new areas and new responsibilities to my skillset.

At Exxon, credit analysis originally focused on smaller companies. Shortly afterwards, there was a shift to a different distribution strategy, working with the larger distributors as a key supplier or branded wholesaler, instead of supplying those smaller companies directly. I then moved to aviation, which gave me a new sector to understand and new metrics to review.

After Exxon, I moved to Euler Hermes to work in their credit department. It was a completely different beast. You went from owning a particular sector to reviewing lots of different sectors at a time.

From credit analysis, I then moved to underwriting, which gives you a much closer relationship with your clients. You’re not just looking at risk assessments and recommending limits; you’re managing a portfolio and working with brokers.

After that, I went to manage the FMCG books for Greensill. There was a need to establish a credit process in that team, so I set up a credit tool to help us score and manage risk. That’s something I like about credit: there’s always more to learn.

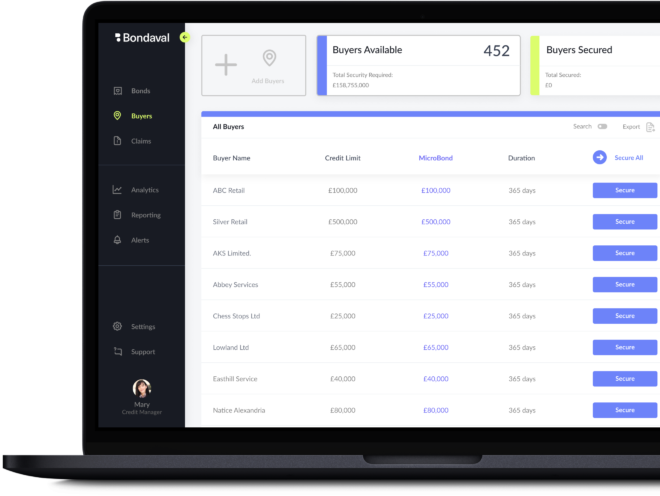

How does Bondaval’s offering compare with what you’ve seen previously?

When I first heard about MicroBonds, I was blown away by the potential impact of them.

One of the struggles if you’re managing exposure on the credit side is when your cover is taken away from you by the insurer. The other big struggle is a bank taking months to renew a bank guarantee, so you either have to trade unsecured or force your customer to find cash to pay for every delivery upfront.

With Bondaval, you get responses in time and you don’t have to worry about losing that security, so you get the chance to build up the relationship with your clients. To me, MicroBonds seemed like something that nobody had thought about, but that virtually everybody needed in the market. And that impression has been borne out: the market has responded very positively to us.

How does Bondaval’s technology support underwriting?

Having worked at one of the largest credit insurers, the data we had there is very similar to what we’re working with here.

One difference that puts us ahead at Bondaval is our ability to use Open Banking to get the most current view of customers on an ongoing basis, not just as a snapshot in time. That means that for smaller companies, where data can be fairly limited, we can get live banking information. This helps us to estimate liquidity, the capital capacity of the company, what their revenue sources are, what their main costs are, and from that, effectively generate the cash flow of the business. All this helps us to understand the business better, which enables us to make decisions on the limits.

Alongside the data, we are also building the lessons that you learn from hands-on experience into the algorithms of the risk decision engine so our underwriting becomes more and more efficient and effective. We build, test, then tweak and adjust until it gets better. It will only get better.

How MicroBonds protect balance sheets -->

How do we work with our clients?

The beauty of our technology is that it gives us the time to interact with and get to know our clients better. Because the technology is able to compile more information, more quickly, we are able to focus on the relationship with the client, understanding their business and then underwriting the risk to suit it.

The most important thing for us is being there for our clients, so they can grow sustainably with peace of mind. That means that our first response should provide our clients with a justified and clear indication of the counterparty’s risk. We do not just say ‘No, we can’t do it’, but ensure we have explored all avenues to obtain the necessary information to assess the risk.

What do you like about being at Bondaval?

I like the leadership you see here. I’m not just talking about the people in senior roles; everyone across the team takes leadership in what they are doing. There is responsibility and accountability. We are all focused on getting the best for our client, and everyone puts in their maximum effort.

We also challenge each other openly: respectfully, but without worrying about how the challenge will be received. People aren’t afraid to say, let’s try doing this in a different way. They feel free to open up and provide their opinions. We all have diverse experiences, so when everyone brings their best, we can give our collective best. That’s exactly the kind of environment we want to foster here.

Companies can grow without challenges, but without them, it’s very easy to go wrong. What’s more, if you didn’t have that challenge, you would be bored. That’s not what we are here for!

Check open jobs at Bondaval -->

The future of B2B credit risk protection

-

Non-cancellable coverage

-

Up to 100% balance sheet protection

-

Secured and adjusted digitally